2024 Schedule B Form 941

2024 Schedule B Form 941. The revised schedule b for form 941 in 2024 streamlines the reporting process for businesses, aligning it with other tax forms. The irs finalized form 941 and all schedules and instructions for 2024.

Final versions of the quarterly federal. The revision is planned to be used for all four quarters.

Several Changes Have Been Made.

When are the form 941 deadlines for the 2024 tax year?

The Irs Recently Released Its 2024 Form 941, Schedule B, And Schedule R Along With The Accompanying Instructions.

The irs finalized form 941 and all schedules and instructions for 2024.

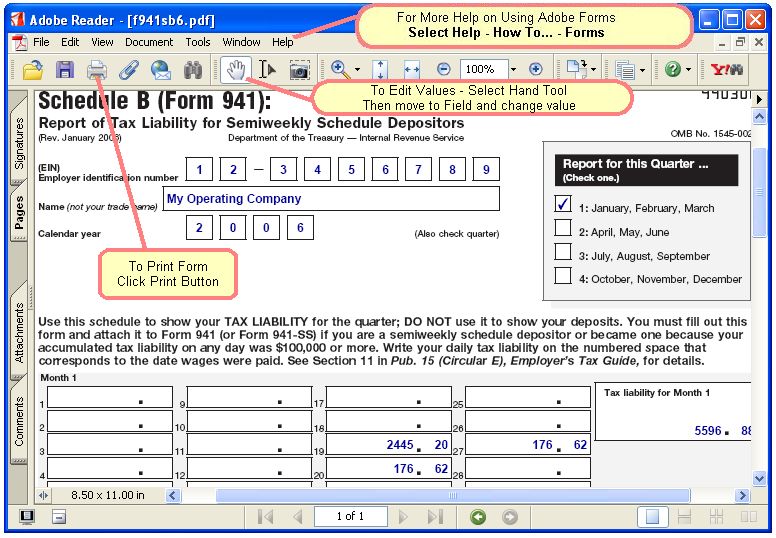

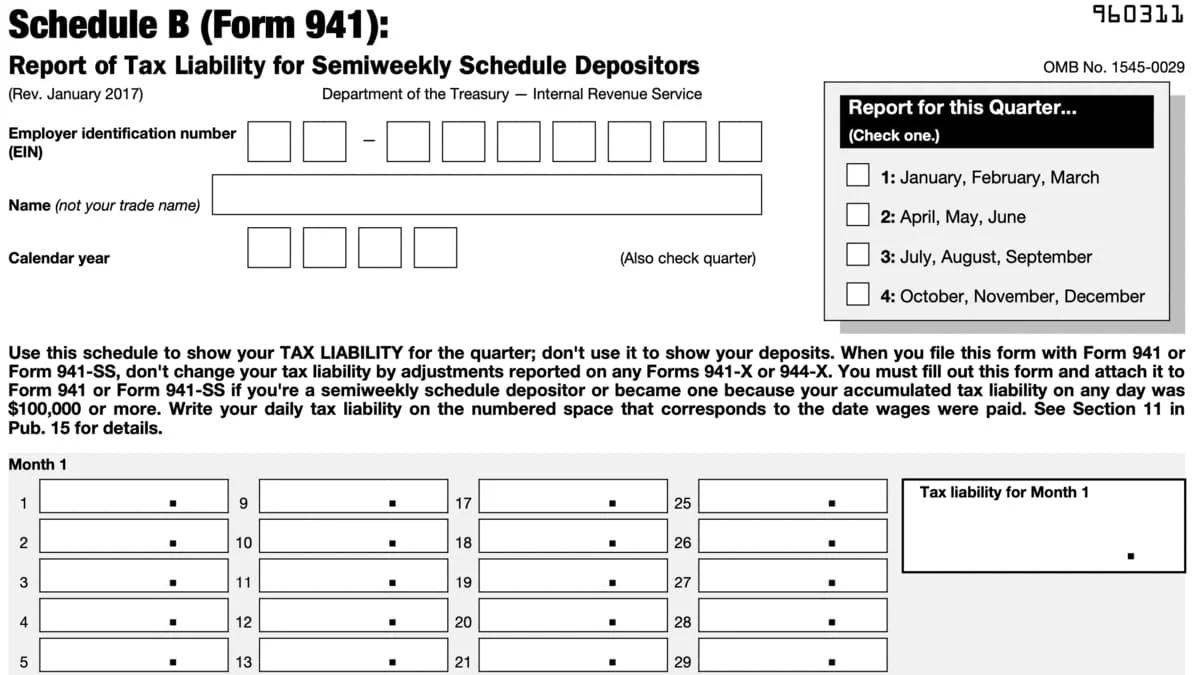

Schedule B, Which Accompanies Form 941, Is A Daily Report Of The Employer's Tax Liability For Federal Income Taxes Withheld From Employees.

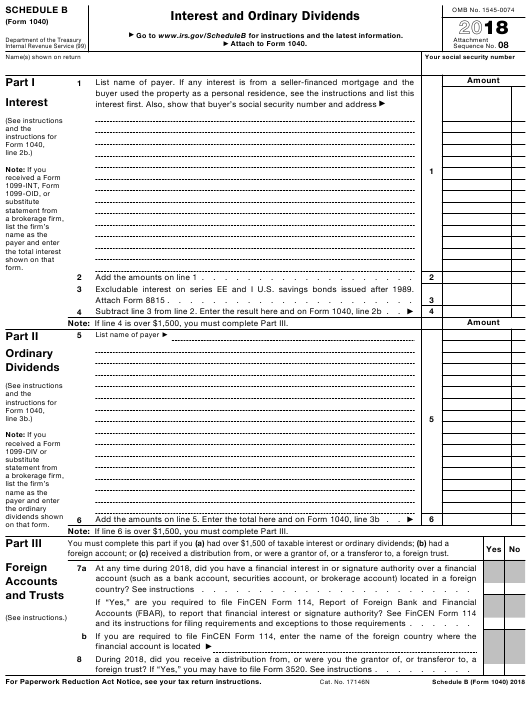

Images References :

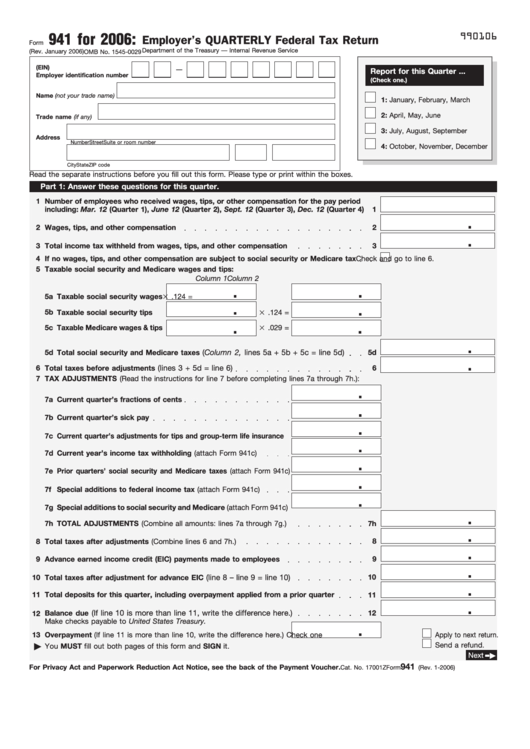

Source: www.signnow.com

Source: www.signnow.com

941 Schedule B 20172024 Form Fill Out and Sign Printable PDF, Form 941 schedule b for 2024 and 2023 is to report tax liability for semiweekly schedule depositors. Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be extremely rare for an employer to pay wages in 2024 for qualified sick and.

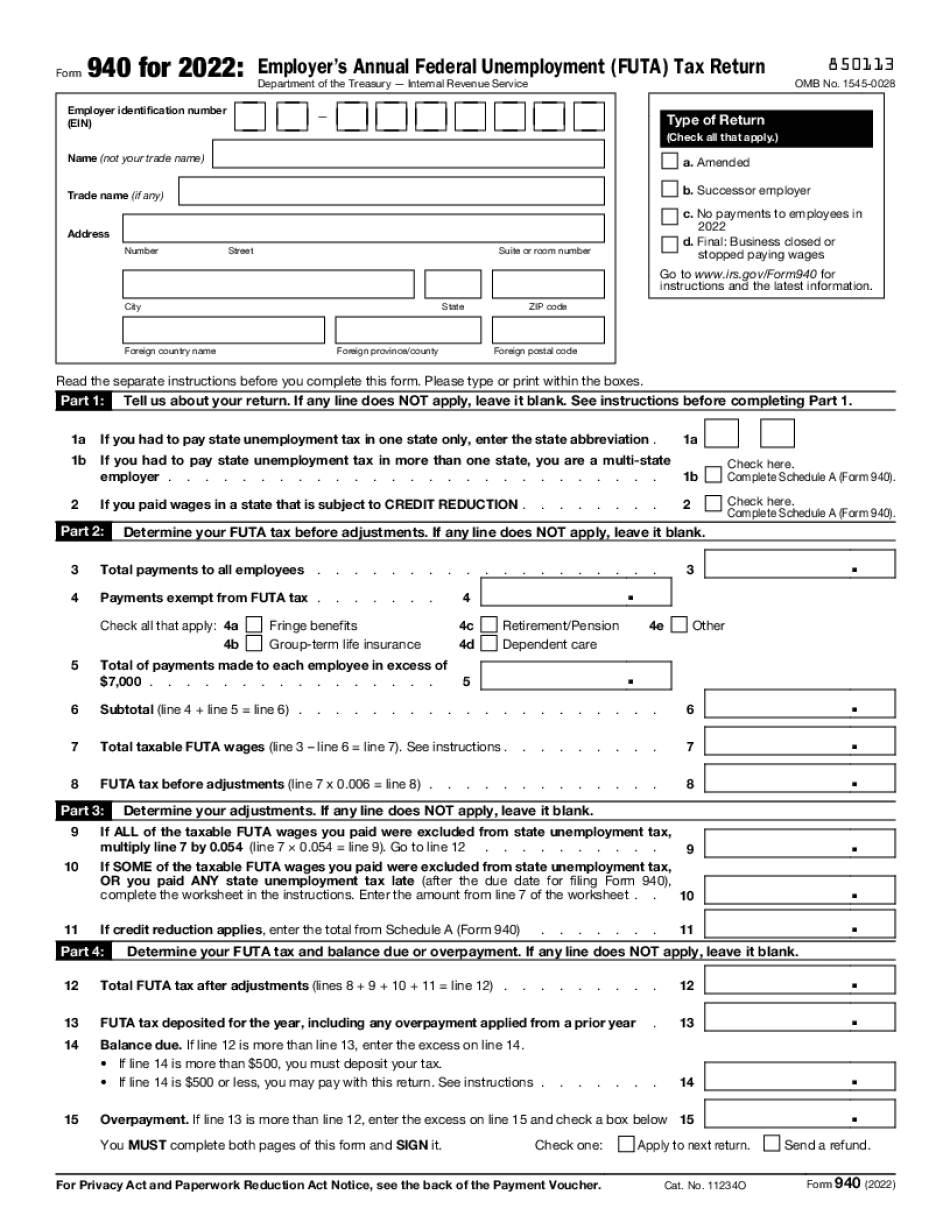

Source: irs-form940-printable.com

Source: irs-form940-printable.com

941 tax form Fill online, Printable, Fillable Blank, Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be extremely rare for an employer to pay wages in 2024 for qualified sick and. You must also complete schedule b, report of tax liability for semiweekly schedule depositors, and attach it to form 941 if you were a semiweekly depositor.

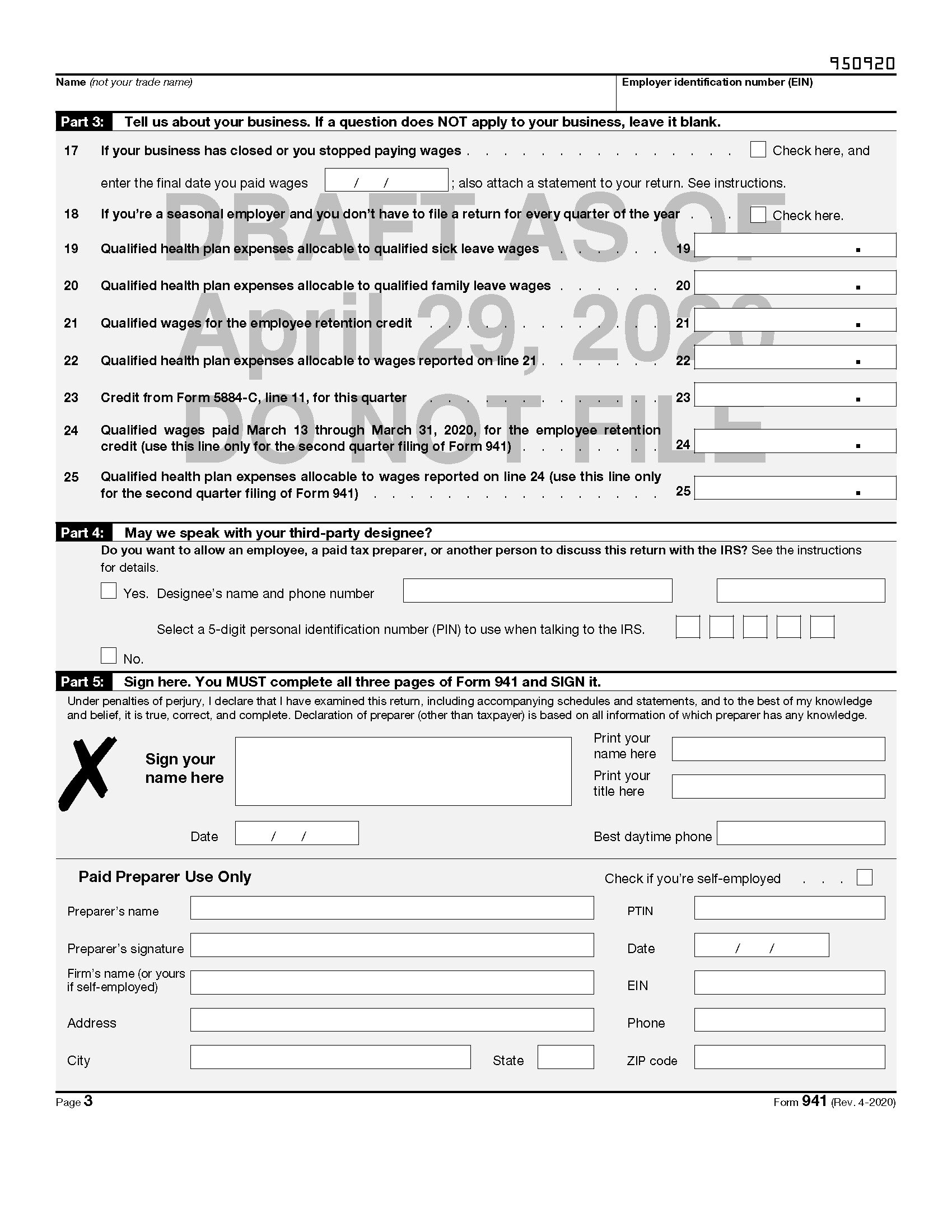

Source: printable.conaresvirtual.edu.sv

Source: printable.conaresvirtual.edu.sv

Printable Form 941, About your business above the section. Line by line review including new tax credit.

Source: smallbizclub.com

Source: smallbizclub.com

How to File Schedule B for Form 941, This webinar covers the irs form 941 and its accompanying form schedule b. Form 941 is utilized to report the social security, medicare, and income taxes withheld from.

Source: www.ruff.com

Source: www.ruff.com

IRS Form 941 Sched B, Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be extremely rare for an employer to pay wages in 2024 for qualified sick and. Several changes have been made.

Source: www.vrogue.co

Source: www.vrogue.co

941 Form 2023 Fillable Form 2023 Vrogue, Form 941 is utilized to report the social security, medicare, and income taxes withheld from. Form 941 schedule b for 2024 is used by semiweekly schedule depositors, reporting more than $50,000 in employment taxes for the previous period.

Source: www.currentfederaltaxdevelopments.com

Source: www.currentfederaltaxdevelopments.com

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES, Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for federal income taxes withheld from employees. S chedule b of form 941, employer’s quarterly federal tax return, is crucial for employers to accurately report their tax liabilities to the internal revenue service.

Source: printableformsfree.com

Source: printableformsfree.com

Free Fillable Form Schedule B Printable Forms Free Online, Final versions of the quarterly federal. Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for federal income taxes withheld from employees.

Source: ellynnqsibilla.pages.dev

Source: ellynnqsibilla.pages.dev

2024 Form 941 Instructions Addie Anstice, Form 941 schedule b for 2024 is used by semiweekly schedule depositors, reporting more than $50,000 in employment taxes for the previous period. This webinar covers the irs form 941 and its accompanying form schedule b.

Source: www.irs.gov

Source: www.irs.gov

3.11.13 Employment Tax Returns Internal Revenue Service, Form 941 schedule b for 2024 and 2023 is to report tax liability for semiweekly schedule depositors. The internal revenue service (irs) has recently released the 2024 form 941, employer’s quarterly federal tax return, along with schedule b, report of tax.

Form 941 Schedule B For 2024 Is Used By Semiweekly Schedule Depositors, Reporting More Than $50,000 In Employment Taxes For The Previous Period.

The 2024 form 941 due.

Final Versions Of The Quarterly Federal.

About your business above the section.